Winning in China in a Multi-Level Coverage Era for Global Pharma

China’s access system is at a turning point. The NRDL continues to dominate, but strict cost ceilings and budget constraints limit how far innovation can go. At the same time, commercial health insurance—once on the margins—is being pulled into the system. The newly introduced C-List offers a pathway to break through NRDL barriers, opening the possibility of a wider revenue window, though one that remains untested.

The question for global pharma is clear: how can companies tap into this opportunity while mitigating risks—optimizing not only their China performance, but also safeguarding global portfolio strategy?

1. Mind the Gap

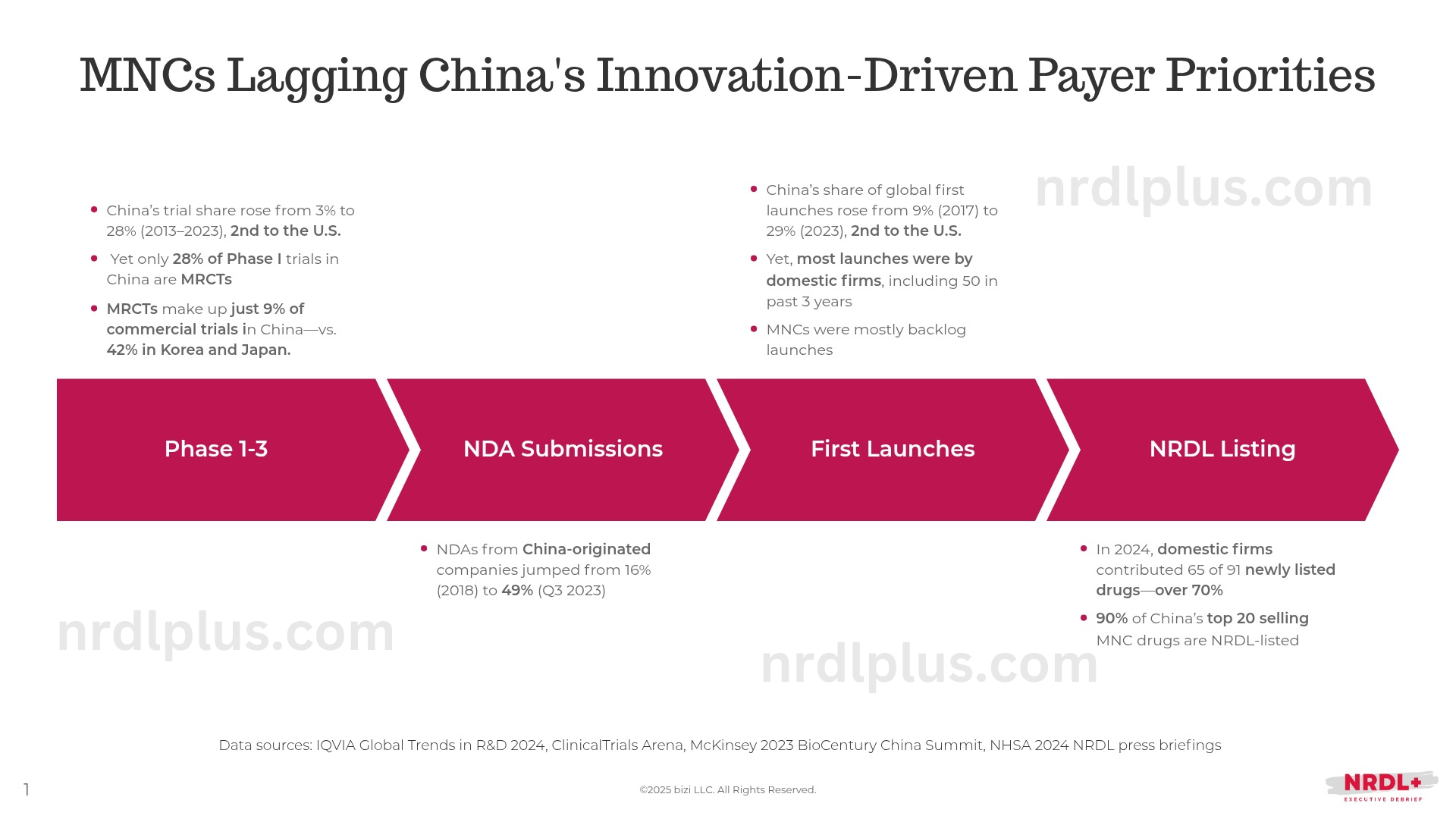

Strategic decisions must be grounded in market realities. Multinational companies (MNCs) are generally trailing China’s rapidly evolving, innovation-driven payer priorities. Several factors contribute to this—from global strategic stance toward China to the country’s enduring affordability constraints. This makes what MNCs choose to do now, and how they prepare for the future, more critical than ever.

From a policy perspective, the direction is unmistakable: pricing and commercial speed are being tied ever more closely to the quality of innovation in China. Domestic players are proving more agile—shifting from fast-follow to first-in-class innovation, and tailoring cost structures to align with payer expectations.

For MNCs, two challenges stand out:

- Geopolitical and supply chain headwinds. Rising geopolitical tensions and supply chain vulnerabilities are reshaping cost structures. Many MNCs have turned to localization—not just to hedge against trade risk, but also to tap into China’s increasingly robust domestic innovation ecosystem.

- Global guardrails vs. local urgency. Global constraints around pricing flexibility can slow adaptation at the very moment Chinese payers expect faster, more tailored responses. Meanwhile, China’s reimbursement infrastructure remains a work in progress: ambitious policy objectives still require stronger execution to reliably reward high-quality innovation.

The call to action: MNCs don’t need to leap blindly, but they do need to reassess long-held pricing assumptions, reset internal expectations, and align global stakeholders on what is changing—and what must change—to compete effectively in China’s evolving access landscape.

2. Adopt a System-Level View

China’s affordability challenge means access to innovation will increasingly depend on an evolving multi-layered coverage framework. Manufacturers must move beyond traditional affordability levers—rebates, discounts, co-pay support—which are product-level tools suited to mature reimbursement systems and fail to capture the dynamic nature of China’s fast-changing landscape.

In China, where social and commercial insurance are beginning to intersect, isolated price concessions are no longer enough. What’s required is a system-level view that considers three dimensions:

- Affordability at the system level – how products interact with layered financing mechanisms, shaped by competitive dynamics, across the entire product life cycle.

- Organizational alignment – whether affiliates are structured and incentivized to reflect China’s new revenue drivers, and whether local teams have the capabilities to engage deeply with the multi-level coverage framework.

- Ecosystem partnerships – how the new financing framework will reshape collaborations: shifting stakeholder incentives, opening new distribution channels, and creating new collaboration pathways that redefine how value is delivered across the healthcare ecosystem.

Ultimately, go-to-market strategies must evolve alongside China’s new funding framework. That shift is only possible when companies look beyond individual products and adopt a true system-level approach.

3. Align with Policy Priorities

In China, “innovation” is no longer judged by clinical evidence alone. Increasingly, it is defined by whether a product advances broader policy goals. While the NHSA has not issued a formal definition for national negotiation, pilots in medical service pricing, provincial procurement listing, and DRG/DIP add-on payments already tie “innovation scores” to both national and local health priorities—from regulatory approval to major public health initiatives. These linkages directly shape pricing flexibility, reimbursement prospects, and go-to-market speed.

As Dr. Wanyan, Deputy Director at Fudan’s China Insurance and Social Security Research Center, has observed, drugs that visibly advance policy objectives can also serve as strategic assets for commercial insurers. By demonstrating alignment with regulators, insurers strengthen their own positioning while broadening market support for such products.

For manufacturers, this means policy orientation is becoming a shared priority across both public and private payers. Success will increasingly depend on developing products that fit within China’s broader health policy agenda—and presenting them not just as therapies, but as policy-aligned solutions that deliver system-level improvements and broader stakeholder value.

Winning in China’s multi-level coverage era will require more than tactical concessions. Manufacturers must first mind the gap—recognizing where global models fall short against China’s fast-moving payer priorities. They must then adopt a system-level view, expanding the affordability lens, ensuring affiliates are organizationally aligned with new revenue drivers, and forging ecosystem partnerships that open new collaboration pathways. And finally, they must demonstrate policy alignment, positioning products not just as therapies, but as solutions that advance China’s broader health system goals. Taken together, these shifts define the playbook for competing effectively in a market where access is no longer a product play, but a system play.